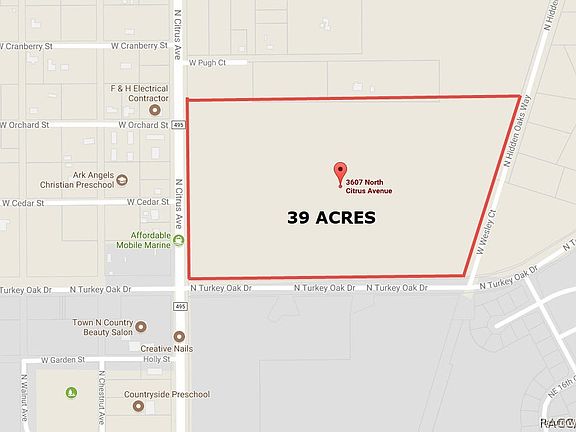

39+ mortgage payment interest vs principal

Mortgage payments rarely end in an even multiple of 100 and zero cents. Round up your monthly payments to the next 100 and pay the difference.

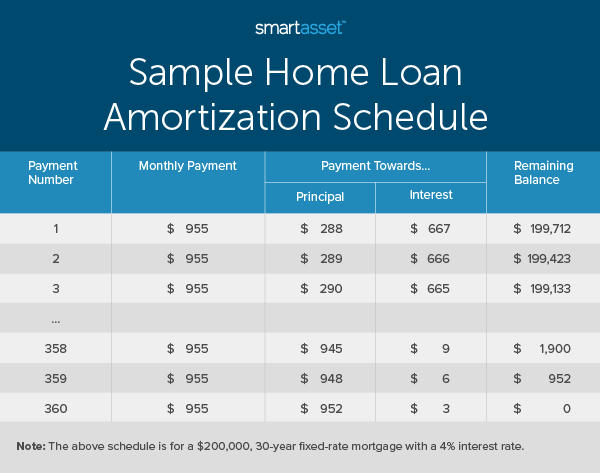

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

If you pay 200 extra a month towards principal you can cut your loan term by more than 8 years.

. Lets use the 300000 fixed-rate mortgage example again with a monthly payment of 1703. Compare Home Financing Options Online Get Quotes. By paying PI youre paying off the mortgage earlier in the term so you end up paying less in interest.

Web Understanding Regular Payments vs Principal Only on a Mortgage I understand the basics a Regular Payment would include accrued interest with the remainder going to. That means your early payments will likely go toward interest rather than principal. Ad Lock In Your Rate With Award-Winning Quicken Loans.

Earn Equity as You Pay Toward the Value of Your Home Your principal is the sum that you borrow when you first take out your home loan. The outstanding mortgage balance after this payment. Ad View A Complete Amortization Payment Schedule How Much You Could Save On Your Mortgage.

By rounding up to the. The rest 1250 went to interest. To find out how.

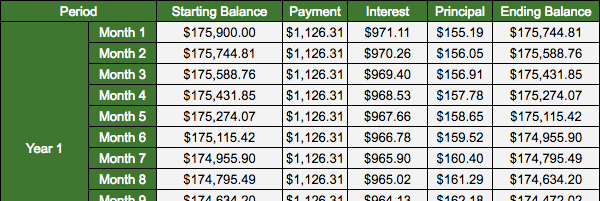

Calculate Your Mortgage Payments With Our Calculator And Learn How Much You Can Afford. Web The monthly payment is 161046. Web The amount of interest that you pay will depend on your principal balance.

Web Mortgage interest is calculated as a percentage of the loan amount which is then added to the principal property taxes insurance premiums and other housing costs. Web Step 3. How Much Interest Can You Save By Increasing Your Mortgage Payment.

A higher principal balance means that youll be paying more mortgage interest. Web What happens if I pay an extra 200 a month on my mortgage. Web The first payment would include an interest charge of 16667 and a principal repayment of 20295.

Web With amortization the initial payments you make will be interest-heavy. Web Principal monthly payment interest payment. Then we can compare principal to interest each month.

So for example if you have a 10000 loan at 6 APR the calculation would look like this. Web The biggest drawback of interest only by far is the cost. That money is lost.

Ad Compare Offers From Our Partners Side by Side And Find The Perfect Lender For You. On your first payment only 360 went to pay off your principal. Web Principal balance APR 12 months Monthly interest payments.

Lets use the formula for determining your principal payment. Web Principal interest mortgage insurance if applicable escrow homeowners insurance and tax total monthly payment If you live in a condo co-op.

W7765 Valerio Road Niagara Wi 54151 Mls 50265997 Listing Information Klapperich Real Estate

Loan Interest Vs Principal Payment Breakdown Calculator

Use The Sign Of Gt Lt Or In The Box To Make The Statement True A 8 4 8 4 B 3 Brainly In

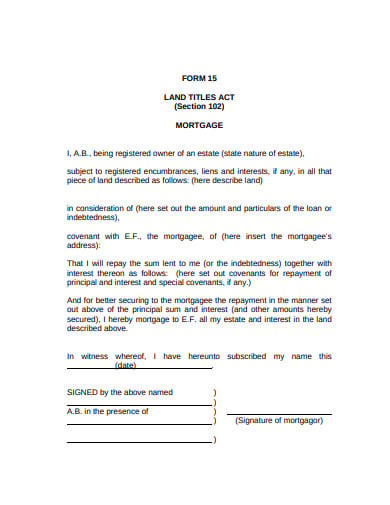

10 Mortgage Form Templates In Pdf Doc

Mortgage Formula With Graph And Calculator Link

Interest Vs Principal Loan Payment Breakdown Calculator

Loan Interest Vs Principal Payment Breakdown Calculator

When Do Homeowners Pay More In Principal Than Interest 2021 Study

Why Are Mortgage Payments Mostly Interest

When Will I Begin Paying More Principal Than Interest

How Does Mortgage Interest Work

Apyxcqnyicfeum

What S Your Mortgage Principal And Interest

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

Mortgage Math 101 Keep Thrifty

Pdf Social Diagnosis 2011 Objective And Subjective Quality Of Life In Poland Full Report Irena Elzbieta Kotowska Academia Edu

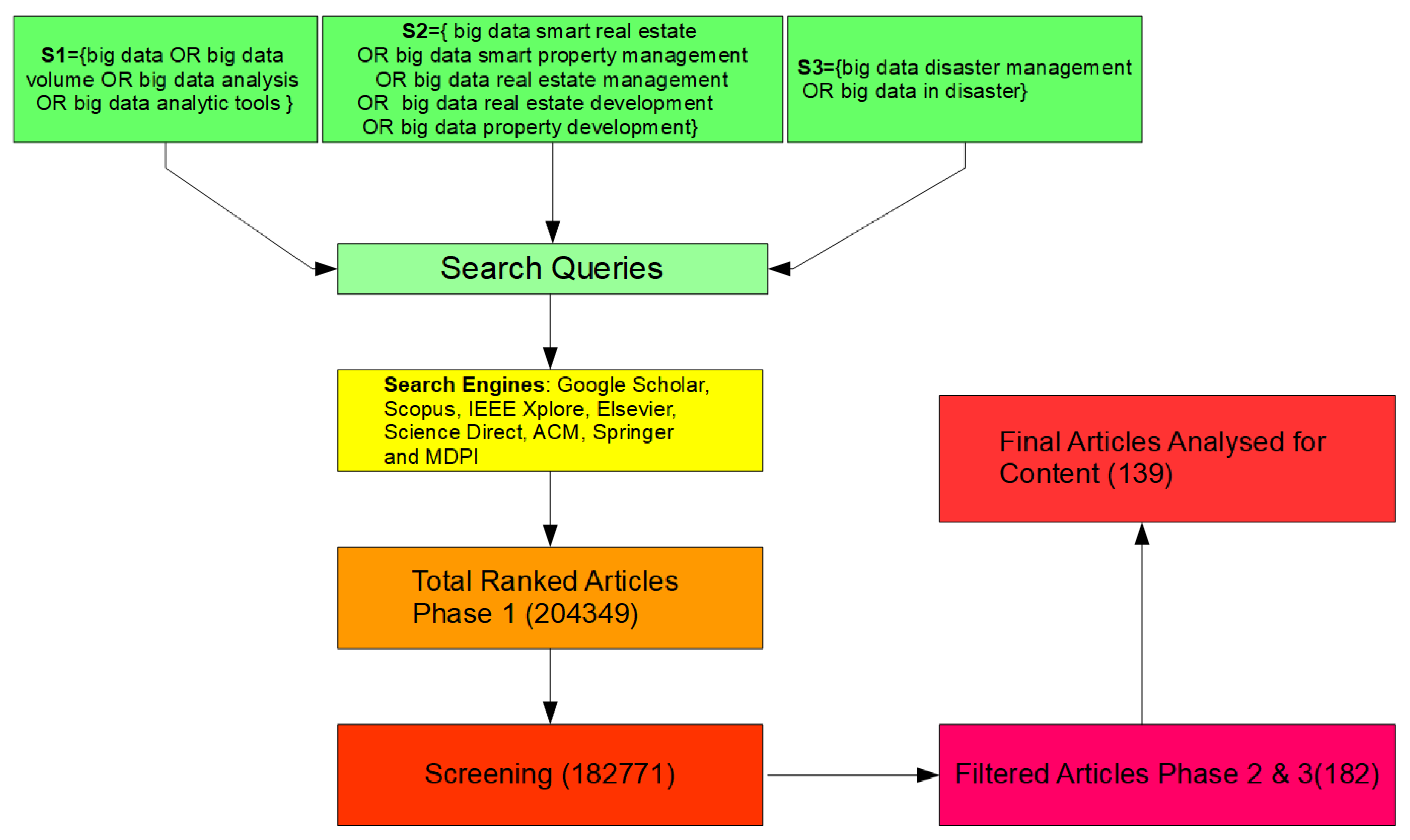

Bdcc Free Full Text Big Data And Its Applications In Smart Real Estate And The Disaster Management Life Cycle A Systematic Analysis